Assalam Alaikum. As you know, the Bank of Punjab announced the latest jobs advertised on its website on 15th October 2024. If you are interested in this job, you will get full information about it on our website. Both men and women can apply for one of the jobs in Punjab.

Interested candidates should submit the necessary documents certificates experience certificates and recent passport-size photographs along with a detailed CV, All shortlisted candidates will be called for an interview.

Before applying for Bank of Punjab Jobs you have to read carefully the job information which is available on our website, we have mentioned everything that is required in detail here. Read and then apply otherwise your application form may be rejected

Table of Contents

Detail Of Jobs In Bank Of Punjab 2024

| Post Date | 15-10-2024 |

| Industry | Bank Of Punjab |

| Jobs Location | Karachi Pakistan |

| Hiring Organization | Bank Of Punjab |

| Last Date | 30-10-2024 |

| Education Require | MBA | CFA |

| No of Posts | 50+ |

| Employment Type | Full Time |

| News Papers | DAWN newspaper |

| Address | Bank Of Punjab Karachi, Pakistan |

Eligibility Criteria For Jobs In Bank Of Punjab 2024

| Education Required | MBA | CFA |

| Age | Upto 55 Years |

| Gender | Male| Female |

| Province/District | Overall Pakistan |

| Experience | 6 Years |

Posts Available In Jobs In Bank Of Punjab 2024

How to Apply For Jobs In Bank Of Punjab 2024

- To apply for Bank of Punjab jobs you must have an MBA degree or its equivalent degree from HEC reorganized University.

- To apply for these jobs you must have six years of experience in corporate investment banking.

- Anyone who wants to apply for Team Leader must know Over-Secure’s Day-to-Day Operational Activities and Transactions to the Team

Apply For Online Jobs In Bank Of Punjab 2024

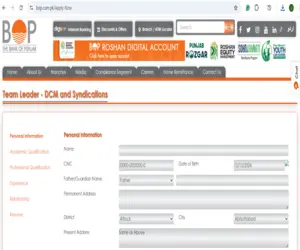

To apply online in Bank of Punjab Kindly directly go to Bank of Punjab website as soon as you go to the Bank of Punjab website click on Careers as given in the screenshot below ever you Click on the required post and click on Apply Now then enter your required data in the application form that opens and submit the application form.

FAQs for Bank of Punjab Jobs 2024

- When were the latest Bank of Punjab jobs announced?

- The latest jobs were announced on October 15, 2024, on the Bank of Punjab’s website.

- Where can I find detailed information about the jobs?

- Full details about the jobs are available on the official Bank of Punjab website.

- Who can apply for these jobs?

- Both men and women from all over Pakistan can apply for the Bank of Punjab jobs.

- What documents are required for the application?

- You need to submit:

- Educational certificates

- Experience certificates

- Recent passport-size photographs

- A detailed CV

- You need to submit:

- What is the last date to apply for the Bank of Punjab jobs?

- The last date to apply is October 30, 2024.

- What is the eligibility criteria?

- Education: MBA or CFA from an HEC-recognized university

- Experience: 6 years in corporate investment banking

- Age: Up to 55 years

- Gender: Male or Female

- What posts are available in this job offering?

- The main position available is “Team Leader – DCM and Syndications.”

- How do I apply for these jobs?

- To apply:

- Go to the Bank of Punjab website.

- Click on the “Careers” section.

- Select the desired post and click “Apply Now.”

- Fill in the application form with the required details.

- Submit your application.

- To apply:

- Is there an option to apply online?

- Yes, you can apply online directly through the Bank of Punjab website by following the instructions provided in the “Careers” section.

- What happens after applying?

- Shortlisted candidates will be called for an interview.

- Where is the job location?

- The available positions are based in Karachi, Pakistan.

- What is the employment type for these jobs?

- These are full-time positions.

- Which newspaper published the job advertisement?

- The job advertisement was published in the DAWN newspaper.

- Can I apply if I do not meet the eligibility criteria?

- It is recommended to carefully read the job information on the website and ensure you meet all the criteria before applying, otherwise, your application may be rejected.

- Where is the Bank of Punjab located?

- The Bank of Punjab’s office for this job listing is located in Karachi, Pakistan.

- How can I contact the Bank of Punjab for more information?

- You can visit their website or check the contact details provided in the job advertisement for any further queries.

Advertisement Of Jobs In Bank Of Punjab 2024

About Bank Of Punjab

Bank of Punjab (BOP):

A Comprehensive Overview

Introduction: The Bank of Punjab (BOP) is a major Pakistani commercial bank with a significant role in the financial landscape of the country. It was established under the Bank of Punjab Act 1989, and it began its operations in 1994. BOP’s growth trajectory has positioned it as a key financial institution, known for its wide array of banking products and services that cater to both individuals and businesses.

History & Evolution:

The bank was originally set up as a provincial bank under the ownership of the Government of Punjab (Pakistan). Initially, it catered primarily to the financial needs of the government and provincial entities, but over time it expanded its services to the general public. With its headquarters in Lahore, Punjab, BOP quickly established a vast branch network across Pakistan, offering a range of banking services.

Over the years, BOP has transformed from a provincial-focused entity to a full-fledged commercial bank. It has continued to grow, expanding its network, product offerings, and customer base, while adapting to the evolving demands of the financial sector.

Ownership & Governance:

- Government Ownership: The Bank of Punjab is a public sector bank and remains under the control of the Government of Punjab, which retains a significant stake in the bank’s ownership.

- Board of Directors: BOP has a professional board of directors comprising financial experts, professionals, and government representatives. The board ensures the bank’s strategic direction, compliance with regulations, and adherence to best corporate governance practices.

Core Services and Products:

BOP provides a broad range of banking products and services, catering to various sectors of the economy, including retail, corporate, commercial, and Islamic banking. Below is a breakdown of the bank’s key services:

- Retail Banking:

- Personal Banking: Savings accounts, current accounts, term deposits, personal loans, auto loans, home loans, and debit/credit card services.

- Consumer Finance: The bank offers a range of financing options for individuals, such as personal loans, car financing, and home loans at competitive rates.

- Remittance Services: BOP facilitates domestic and international remittances, enabling expatriates and businesses to transfer funds efficiently.

- Corporate and Commercial Banking:

- Corporate Finance: BOP offers financing solutions to corporates, including working capital finance, project finance, trade services, and term loans. The bank focuses on sectors like agriculture, textile, manufacturing, and SMEs (Small and Medium Enterprises).

- Trade Finance: The bank supports trade activities by providing letters of credit, guarantees, and other services to facilitate international and domestic trade.

- SME Financing: To promote entrepreneurship and business growth, BOP has a wide range of tailored financial products designed to support small and medium enterprises.

- Islamic Banking: BOP offers Shariah-compliant banking solutions under its dedicated Islamic banking division. This includes Islamic savings accounts, current accounts, and financing products like Murabaha, Ijarah, and Diminishing Musharakah.

- Digital Banking: In line with global digital transformation trends, BOP has embraced technology to enhance customer experience. This includes:

- Internet and Mobile Banking: Enabling customers to perform transactions, pay bills, and manage their accounts through mobile apps and online banking portals.

- ATM Network: The bank has a widespread ATM network across the country, providing 24/7 banking convenience to its customers.

- Branchless Banking: Through strategic partnerships with telecom companies, BOP also offers branchless banking solutions, providing services to remote and underserved regions.

Strategic Initiatives & Achievements:

- Financial Growth: The bank has shown consistent growth in terms of its assets, deposits, and profitability. Over the years, BOP has grown its balance sheet, with increasing revenues and a growing base of both corporate and individual customers.

- Branch Network: BOP has over 600 branches across the country, ensuring a strong physical presence in major cities as well as rural areas. This network allows it to reach a broad customer base, including small businesses, large corporations, and individual clients.

- Recognition and Awards: The Bank of Punjab has been recognized for its contributions to the financial sector and its customer-centric approach. It has received several awards over the years for excellence in banking and innovation.

Corporate Social Responsibility (CSR):

BOP is also actively engaged in corporate social responsibility initiatives. The bank is involved in various social welfare projects, particularly in areas related to education, healthcare, and disaster relief. Its CSR activities focus on sustainable development, environmental protection, and community upliftment.

Challenges and Risks:

Despite its growth, BOP faces challenges common to the banking industry, including economic fluctuations, regulatory requirements, and competition from both local and international banks. In recent years, the bank has worked on improving its risk management framework, enhancing its credit risk policies, and adopting better corporate governance practices.

Future Outlook:

BOP is poised for continued growth, with plans to further expand its product offerings, digital banking capabilities, and branch network. The bank is focused on innovation and modernization to remain competitive in the evolving financial landscape of Pakistan. The continued support from the Government of Punjab provides a stable platform for the bank to grow and meet the rising demands of its diverse customer base.