Agricultural Development Bank has announced the latest jobs. Its advertisement is also published in the newspaper. This bank offers good jobs and reasonable salary packages. If you are interested in bank jobs, then you need to know about this. Information will be available on our website, Career Jobs Provider.

This bank is the best institute in Pakistan, primarily focused on providing banking services to the agriculture sector. To apply, you have to provide all the documents and your information on the website page and submit the application. After that, you have to wait for the interview because you will be selected on the basis of merit.

Table of Contents

Detail Of Zarai Taraqiati Bank Limited Jobs

| Post Date | 23-10-2024 |

| Industry | Zarai Taraqiati Bank Limited |

| Jobs Location | Islamabad Pakistan |

| Hiring Organization | Zarai Taraqiati Bank Limited |

| Last Date | 3-11-2024 |

| Education Require | Masters |

| No of Posts | 5+ |

| Employment Type | Full Time |

| News Papers | Dawn Newspaper Express Newspaper |

| Address | Islamabad Pakistan |

Eligibility Criteria For Zarai Taraqiati Bank Limited Jobs

| Education Required | Bachelors |

| Age | 50+ Years |

| Gender | Male| Female |

| Province/District | Islamabad Pakistan |

| Experience | 10 Years |

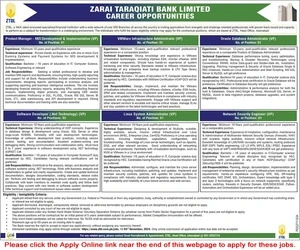

Posts Available In Zarai Taraqiati Bank Limited

- Product Manager MIS Development and Implementation

- Wmware Infrastructure Administrator

- Oracle Database Administrator

- Software Developer ( Net Technology )

- Linux System Administrator

- Network Security Engineer

FAQs About Zarai Taraqiati Bank Limited

Q1: What job positions are available at Zarai Taraqiati Bank Limited?

A1: The available positions include:

Product Manager MIS Development and Implementation

VMware Infrastructure Administrator

Oracle Database Administrator

Software Developer (Net Technology)

Linux System Administrator

Network Security Engineer

Q2: What is the eligibility criteria for these jobs?

A2: Candidates must meet the following criteria:

Education: Bachelor’s degree

Age: 50+ years

Gender: Male and Female candidates are eligible

Experience: 10 years of relevant experience

Q3: What is the application process?

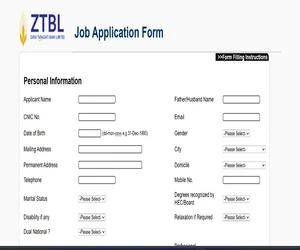

A3: To apply, follow these steps:

Visit the official ZTBL website.

Browse the available job listings and choose your preferred position.

Fill out the job application form with your personal information, educational background, and work experience.

Submit your application as per the instructions provided on the website.

Q4: What is the last date for applying for the jobs?

A4: The last date to submit applications is November 3, 2024.

Q5: Where is the job location?

A5: The job positions are based in Islamabad, Pakistan.

Q6: Is there a specific publication where the job advertisement is listed?

A6: The job advertisement has been published in Dawn and Express newspapers.

Q7: What type of salary package does ZTBL offer?

A7: ZTBL offers a reasonable salary package, but specific details may vary by position. It is advisable to check the website or inquire during the interview.

How to Apply For Zarai Taraqiati Bank Limited Jobs

First, read all the information about this job on our website carefully so that you do not make any mistakes while filling out the form.

If you are interested in bank jobs, then you must apply in this job, these people are also offering good salary and both men and women can apply here.

If you meet their eligibility criteria, you can visit their official website and fill out the form.

Before you submit your application it is important to read the instructions carefully

Apply For Online Zarai Taraqiati Bank Limited Jobs

You have to follow the rules given below to apply online in this job

- Visit the official website https://ztbl.com.pk/jobs/.

You can visit their official website ZTBL through the link given. - Find a suitable job according to your preference.

There you will see all the available jobs, you can choose your favorite job according to your calculations and be provided with all the job details. - Fill out the job application form.

After finding your desired job you have to apply in it as shown in the below screenshot while filling out the job application form you have to provide all your personal information educational background working experience. Then you can submit your form.

Advertisement Of Zarai Taraqiati Bank Limited Jobs

About Zarai Taraqiati Bank Limited

Zarai Taraqiati Bank Limited (ZTBL), previously known as the Agricultural Development Bank of Pakistan (ADBP), is a major financial institution in Pakistan dedicated to agricultural development and the provision of rural credit. Established to support the country’s agrarian economy, ZTBL has played a vital role in promoting the agricultural sector, providing farmers with financial resources, and enhancing rural development.

History and Background

ZTBL was founded in 1961 as the Agricultural Development Bank of Pakistan (ADBP) following the merger of the Agricultural Development Finance Corporation (ADFC) and the Agricultural Bank of Pakistan. It was established under the Agricultural Development Bank Ordinance to provide financial services specifically for the agriculture sector, including farming, livestock, and related industries.

The primary objective of the bank was to provide affordable credit to the rural population, especially farmers, to boost agricultural productivity and rural income. Over the years, ADBP expanded its operations and improved its infrastructure to reach a broader range of clients in rural areas.

In 2002, the ADBP was restructured, and its name was changed to Zarai Taraqiati Bank Limited. This change was part of the government’s broader initiative to reform state-owned enterprises and make them more commercially viable and sustainable. The bank’s transformation involved a shift towards a more modern banking structure while retaining its core focus on agriculture.

Mission and Vision

- Mission: ZTBL’s mission is to provide affordable, innovative, and sustainable financial services to rural communities, particularly small and medium-sized farmers, to improve agricultural productivity, reduce rural poverty, and promote rural economic development.

- Vision: The bank envisions becoming the leading financial institution in Pakistan’s agriculture sector by offering comprehensive financial services that cater to the diverse needs of rural areas, including credit, savings, insurance, and technology.

Key Objectives

ZTBL’s key objectives are aligned with its mission to promote agricultural development and rural prosperity:

- Credit Provision: The primary objective is to provide agricultural credit to farmers at concessional rates. These loans are intended to support crop production, livestock farming, agro-processing, and other agriculture-related activities.

- Rural Development: ZTBL aims to support rural development by facilitating investments in agricultural technology, machinery, and infrastructure, enabling farmers to increase their yields and improve their livelihoods.

- Promotion of Modern Agricultural Practices: The bank encourages the adoption of modern agricultural techniques and technologies through its financing programs, helping farmers transition from traditional to more efficient farming methods.

- Financial Inclusion: ZTBL focuses on financial inclusion by reaching out to underserved populations in rural areas, ensuring they have access to banking and credit facilities.

- Capacity Building: ZTBL engages in capacity-building initiatives for farmers by offering training and education in agricultural best practices, helping them improve their productivity and financial management.

Products and Services

ZTBL offers a range of financial products and services tailored to the needs of the agricultural sector:

- Agricultural Loans: These loans are designed for farmers to meet their seasonal agricultural needs, such as purchasing seeds, fertilizers, pesticides, and other inputs for crop production. ZTBL offers both short-term and long-term loans based on the nature of the agricultural activity.

- Farm Mechanization Loans: ZTBL provides loans for purchasing farm machinery and equipment, including tractors, harvesters, and irrigation systems. This helps farmers increase their efficiency and productivity through mechanization.

- Livestock Loans: The bank also offers loans for livestock farming, enabling farmers to invest in dairy farming, poultry, sheep, and other livestock-related activities.

- Agri-Business Loans: ZTBL extends credit to small and medium-sized agri-businesses, including those involved in food processing, agro-based industries, and storage facilities.

- Rural Development Loans: ZTBL provides financing for rural infrastructure development, including the construction of farm-to-market roads, irrigation channels, and storage facilities.

- Microfinance: ZTBL has a microfinance program targeting small farmers and rural entrepreneurs who need small-scale loans for their farming activities or small businesses.

- Deposit Products: While primarily focused on lending, ZTBL also offers deposit services, allowing rural customers to save money securely and access a range of savings products.

Organizational Structure

ZTBL is a government-owned institution, and its board of directors is appointed by the Government of Pakistan. The bank operates under the regulatory framework set by the State Bank of Pakistan (SBP). Its operations are managed by a professional team, with the bank having a nationwide presence through its extensive branch network.

ZTBL has over 400 branches across Pakistan, ensuring that it can serve even the most remote rural areas. Its outreach is one of its strongest attributes, as it can provide credit and banking services to regions where commercial banks may not have a presence.

Technology and Innovation

In recent years, ZTBL has embraced technological innovation to improve its services. It has launched initiatives to digitize its banking operations, including the introduction of an online banking platform and mobile banking services. These efforts are aimed at making it easier for farmers and rural customers to access financial services without having to visit a physical branch.

The bank is also involved in projects related to agricultural technology (AgriTech), supporting farmers in adopting modern tools like smart irrigation systems, weather forecasting services, and satellite-based monitoring of crops.

Challenges

Despite its achievements, ZTBL faces several challenges:

- Non-Performing Loans (NPLs): Like many state-owned banks, ZTBL has struggled with a high level of non-performing loans. Some farmers face difficulties repaying loans due to crop failures, natural disasters, and market fluctuations, which can strain the bank’s financial health.

- Limited Capital: Although ZTBL plays a crucial role in agricultural financing, it has limited capital compared to the growing demand for credit in rural areas. Expanding its capital base to meet the needs of farmers is an ongoing challenge.

- Operational Inefficiencies: As a large government-owned institution, ZTBL has faced criticism for operational inefficiencies, bureaucratic delays, and a lack of flexibility in responding to the evolving needs of the agricultural sector.

- Competition from Commercial Banks: With the entry of commercial banks into agricultural financing, ZTBL faces increasing competition. These banks often offer more flexible products and faster processing times, posing a challenge to ZTBL’s dominance in rural credit markets.

Role in Pakistan’s Agricultural Development

ZTBL has been a cornerstone of Pakistan’s agricultural economy, supporting millions of farmers over the decades. It has played a key role in increasing crop production, promoting mechanization, and enabling rural entrepreneurs to expand their operations.

With Pakistan’s economy heavily reliant on agriculture, which accounts for around 20% of the country’s GDP and employs nearly 40% of the labor force, ZTBL’s role in ensuring a sustainable and productive agricultural sector is crucial. The bank is instrumental in achieving national food security goals and rural poverty alleviation.

Future Outlook

ZTBL is expected to continue evolving to meet the challenges of modern agriculture and rural development. To remain relevant and effective, the bank will likely focus on expanding its technological capabilities, improving its financial health, and addressing the needs of a changing agricultural landscape marked by climate change, water scarcity, and evolving market dynamics.

With reforms and continued support from the government, ZTBL has the potential to remain a key player in promoting agricultural growth and rural prosperity in Pakistan.